Zelle And Taxes 2025 Changes. Tax code has many provisions that are adjusted for inflation and some that aren’t. Zelle® does not impose taxes on transactions made on its network.

You can’t hold a balance directly on zelle like you can on venmo or paypal. That brings the total deferral limit to $34,750 for these workers.

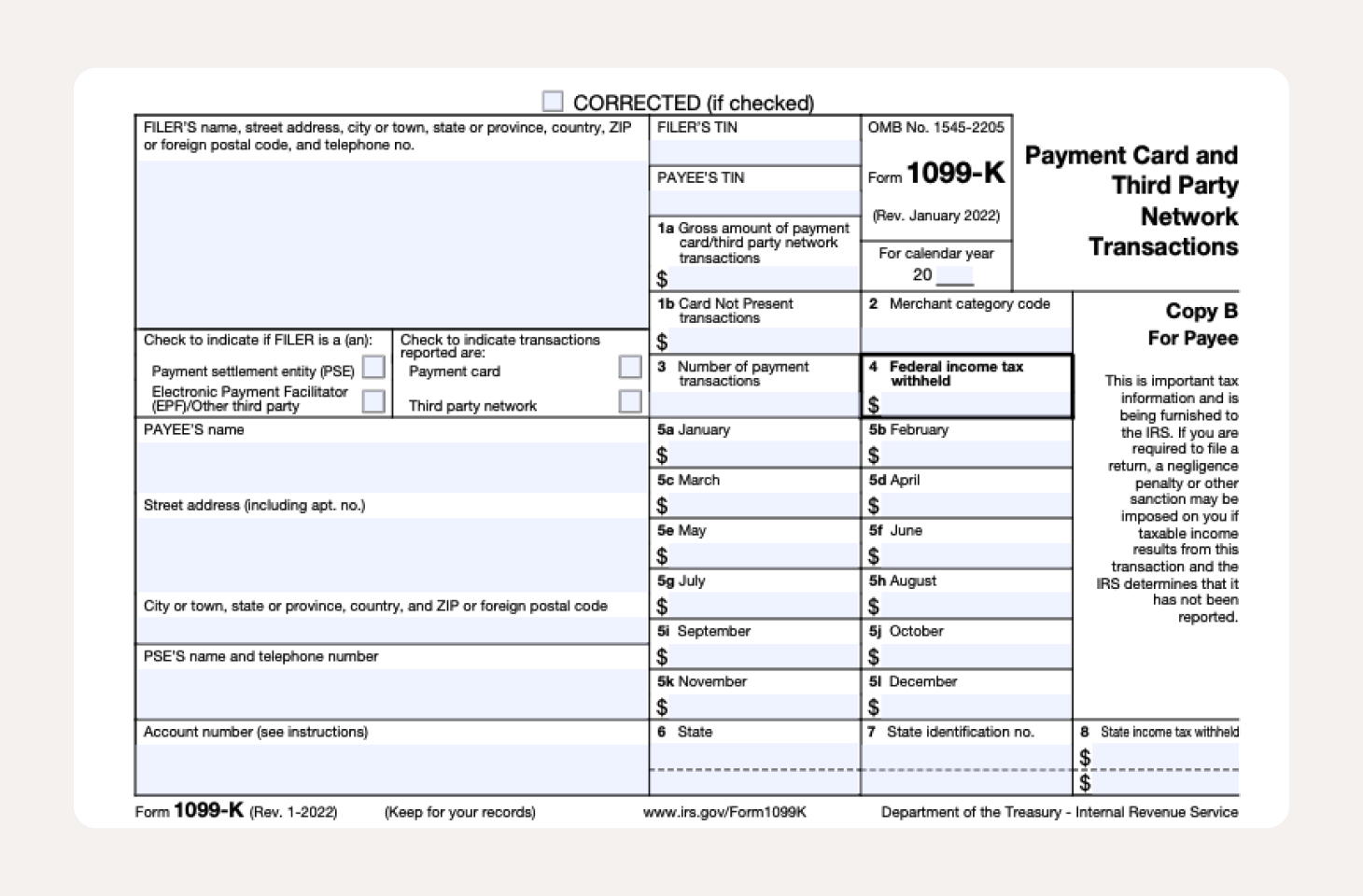

What’s the Zelle Tax Loophole? New IRS Guidelines, Explained, Starting in 2025, digital wallet users will face new irs regulations for income reporting.

Zelle Taxes Does Zelle Report to the IRS?, If you’re a freelancer or gig worker who receives payments via apps like venmo, zelle, cash app or paypal, your tax reporting requirements will change for the 2025 tax year.

Zelle Taxes Does Zelle Report to the IRS?, That brings the total deferral limit to $34,750 for these workers.

YouTuber Taxes Made Easy A Complete Guide to Filing & Deductions Medium, That’s on top of the $23,500 maximum in.

What You Need to Know About the Zelle and Venmo Tax Changes Lisa Chastain, You may be wondering if zelle reports your transactions to the irs, especially with new tax reporting rules in 2025.

Zelle Taxes Does Zelle Report to the IRS?, However, zelle stands out as the exception, exempt from these requirements.

Taxes por usar Zelle y Formulario 1099k YouTube, Among these changes, new users will no longer be able to enroll in the zelle® app after january 8, 2025, and existing users will no longer be able to send or receive money using the zelle® app after march 31, 2025.

The Basics of Zelle Taxes How to Pay and File, Understanding zelle tax reporting can help you navigate your obligations and avoid potential pitfalls.

Does Zelle Report to the IRS? Zelle Tax Implications and Regulations, In recent years, zelle has.

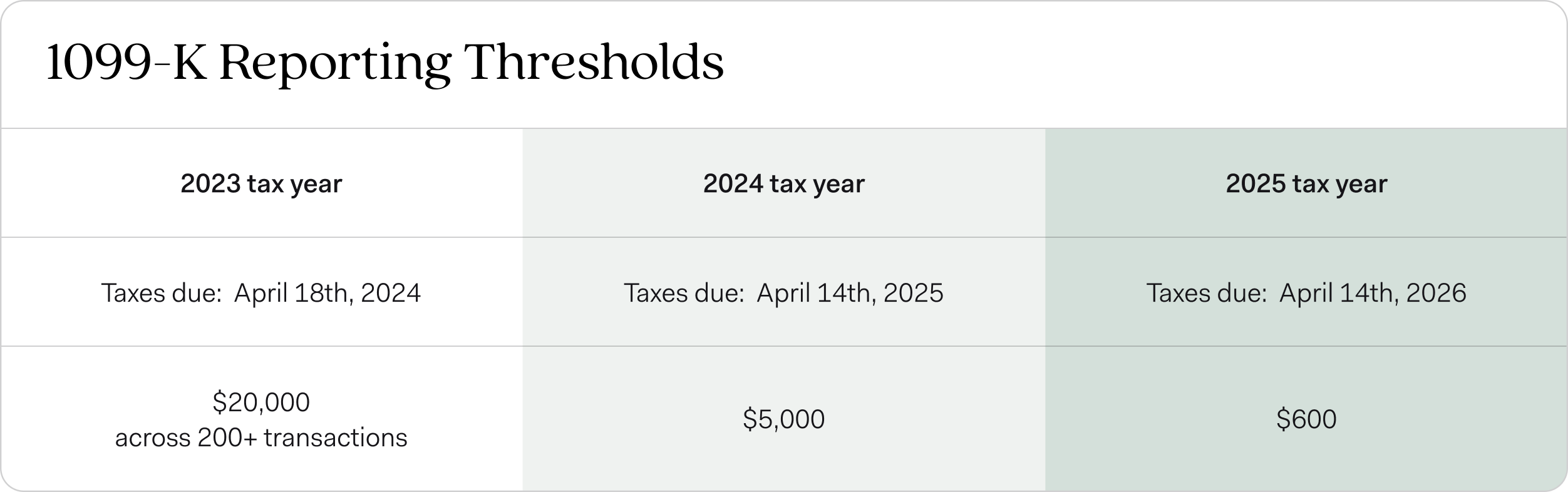

Zelle Tax Loop Explained. As Of Jan 1 ,2025 Venmo, PayPal, Cash… by, For the 2025 tax year—meaning the taxes that will be due in the spring of 2025—the irs is planning to roll out a $5,000 reporting threshold.